The French plastics packaging segment is negatively impacted by oil price volatility, increased environmental awareness and stricter regulations.

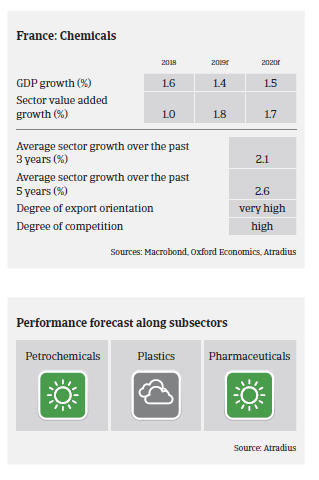

Demand for French chemical products is still growing, although at a slower pace since H2 of 2018, due to weaker demand from key buyer industries (e.g. automotive and construction in Europe), lower growth in China and increased uncertainty over trade disputes. The industry is highly export-oriented and benefits from a diversification of end-markets and high R&D spending. That said, high labour costs and regulatory burdens are competitive disadvantages.

- Most French chemicals businesses have elevated profit margins. However, margins deteriorated over the past 12 months due to higher input prices (notably naphtha). That said, margins will remain stable over the coming six months as input prices are not expected to increase sharply in this period and gas prices in Europe are decreasing. While the gearing of businesses is generally high in this capital-intensive sector, it benefits from the willingness of banks to lend and currently low interest rates.

- Payment experience has been good over the last couple of years, and the level of protracted payments is low. High dependency on suppliers along the value chain usually prevents buyers from paying late. The number of non-payment and insolvency cases was low in 2018 and H1 of 2019. This trend should remain unchanged over the coming 12 months, despite higher input prices and decreasing global demand for chemicals. This is somehow bucking the trend of French business insolvencies development, which we forecast to increase 3% in 2019.

- Due to the stable business performance and good credit risk situation our underwriting approach is very open to almost all major subsectors (petrochemicals, basic chemicals, pharmaceuticals).

- We are more cautious when underwriting the plastics (packaging) segment. This subsector has recorded an (albeit modest) increase in non-payment notifications over the past 12 months, and is impacted by oil price volatility, increased environmental awareness and stricter regulation (e.g. EU plans to ban the use of single-use plastics by 2021).

- In the long-term the French basic chemicals subsector performance could be impacted by deteriorating international competitiveness and the fact that investments have decreased.

Relaterede dokumenter

826KB PDF