As in previous years, competition remains strong in the domestic market, mainly among small and medium-sized machinery companies depending on construction.

- Lower growth in 2018 and 2019 expected

- Payments take 110 days on average

- Still subdued performance in the construction-related segment

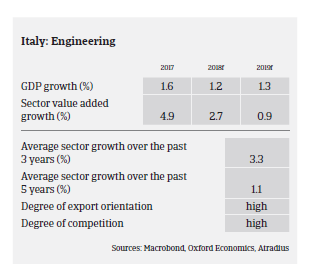

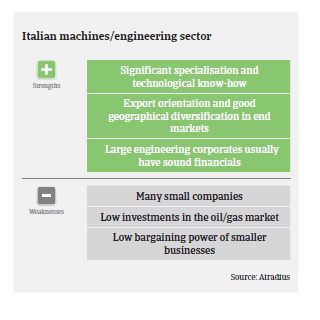

The Italian machines/engineering sector has proved to be relatively resilient during the downturn in Italy´s economic performance after 2008, due to its export orientation, high specialisation and added-value products in precision mechanics. Value added growth of the industry rose by about 5% in 2017, but the increase is expected to slow down in 2018 (up 2.7%) and 2019 (up 0.9%), in line with lower economic growth.

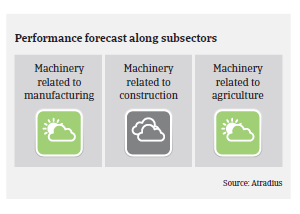

As in previous years, competition remains strong in the domestic market, especially among small and medium-sized machinery companies dependent on construction businesses. While domestic capital investment growth has picked up again since 2016, performance of the construction and road machinery segment is still hampered by the slow construction rebound in Italy. The earthmoving machinery segment is highly dependent on public works and therefore exposed to structurally slow payments by public entities. At the same time, demand for machinery related to the oil and gas sector remains subdued, as investments have declined during the period of low oil prices, and have not rebounded yet.

In contrast, the machinery segment dependent on the manufacturing sector continues to benefit from export growth and increased domestic market demand (especially from the automotive and food sectors). Larger and more diversified machinery companies and export-oriented SMEs are expected to improve performance and cash generation. Machinery businesses related to agriculture and food have performed well in 2018, but sales are expected to decrease slightly in 2019.

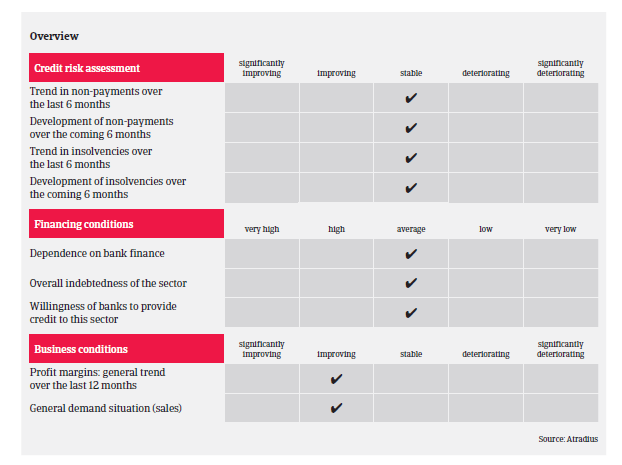

Overall profit margins of machinery businesses are rather high compared to other Italian industries, and are expected to improve further in the coming 12 months, at least in the growing subsectors. As in 2017, payment duration in the Italian machinery sector is still 110 days on average. Payment experience has been good over the past two years, and the level of protracted payments is low. Non-payment notifications have been stable over the last 12 months, and are expected to remain low in the coming months. The number of insolvencies in the machinery sector is relatively low, and expected to level off or even to decrease slightly in 2019.

Our underwriting approach remains generally open, especially for larger businesses and niche export-focused subsectors (e.g. high precision mechanical works). Those businesses usually show solid financials and a good liquidity profile. However, we are still more cautious about companies operating in still difficult end-sectors (e.g. construction) and which are dependent on public entities. We also closely monitor machinery businesses that produce components and plants for the oil and gas sector.

Relaterede dokumenter

991KB PDF