In 2018, respondents in Japan reported an increase in overdue B2B invoices and a longer time to convert B2B invoices into cash.

Respondents in Japan have maintained their credit friendly stance, trading on credit to nurture long-term cooperation and expand business domestically and internationally. In 2018, respondents reported an increase in overdue B2B invoices and a longer time to convert B2B invoices into cash. Bankruptcy and high costs to pursue debtors are top reasons for writing off B2B receivables as uncollectable. What has changed over the course of the year, what are the main reasons for payment delays and what was reported about payment practices by industry?

Credit sales for continued collaboration and new opportunities

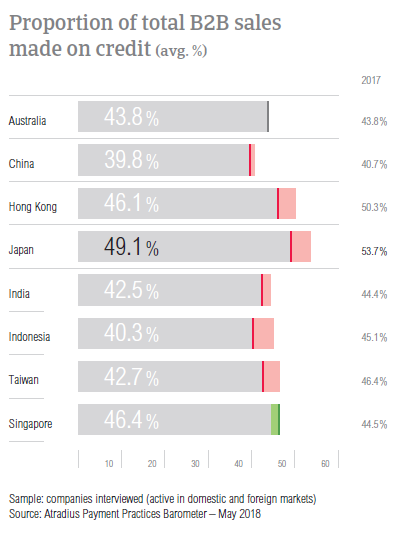

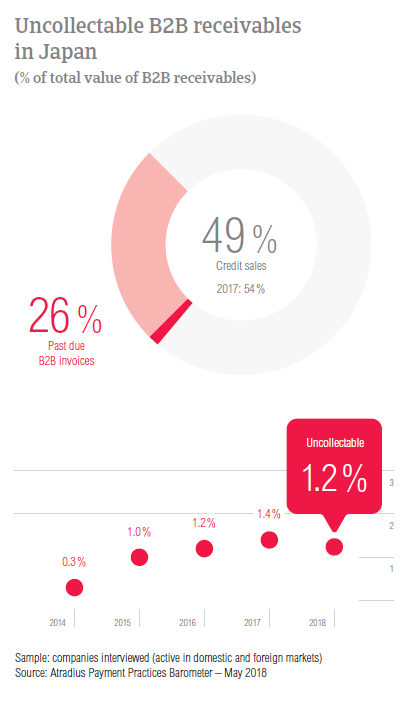

Historically, respondents in Japan have been the most inclined to sell on credit terms in the Asia Pacific region. Despite a decrease of almost five percentage points this year, survey results point to the same open stance with 49.1% of B2B sales made on credit. Respondents are clearly more comfortable selling on credit to domestic B2B customers, for which the proportion of total B2B sales made on credit is much higher than that registered with foreign B2B customers (56.5% versus 41.7%).

Japanese respondents said that they are granting trade credit to their domestic B2B customers mostly because their creditworthiness has been well established over long-term business relationships and because it is the usual business practice. Credit sales are also perceived as a way to ensure cash flow and expand business domestically. While very inclined to offer credit to domestic B2B customers, 61.9% of respondents in Japan said that poor payment behaviour of customers would result in them refusing to grant credit terms. Other frequently cited reasons why companies here refuse to grant trade credit to their domestic B2B customers are a lack of information on the customer’s business and payment performance and the financial weakness of the customer (each of these reasons were mentioned by 42.9% of respondents).

We offer credit terms based on our trading experience and if the customer’s has a high creditworthiness.

Japanese companies grant trade credit to their foreign B2B customers to further generate sales and expand their international activity. Similarly to what was mentioned in regards to domestic B2B customers, Japanese respondents use credit sales because it is common practice in the industries they operate in. Respondents in Japan refuse credit sales to their foreign B2B customers because of high economic and political risk in the customer’s country and because of the customer’s poor payment behaviour (each of these reasons was mentioned by 54.6% of respondents).

We trade on credit because it is common practice.

A higher proportion of overdue B2B invoices

In 2018, Japan remains the country with the lowest percentage of respondents reporting late payment by their B2B customers (70.2%). Unlike other countries in the region, the frequency of late payment was much higher with foreign B2B customers than with domestic B2B customers (76.9% versus 63.5%).

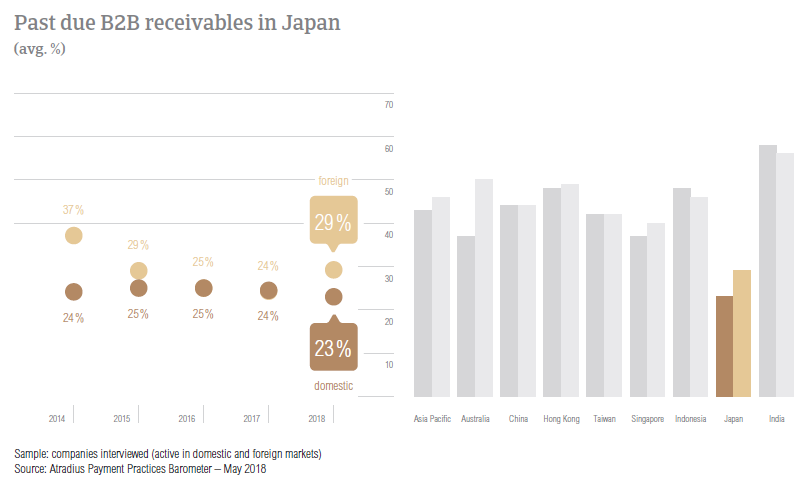

Respondents in Japan reported an increase in the proportion of overdue B2B invoices, from 23.6% in 2017 to 26.3% this year. This reflects a sharp increase in the proportion of foreign past due B2B invoices. However, and despite the increase, this is by far the lowest proportion of past due B2B invoices in the region.

In 2018, the average Days Sales Outstanding (DSO) figure recorded in Japan is 44 days, one day longer than in 2017. Most respondents in Japan (84.6%) do not expect any changes in their company's DSO over the coming 12 months. Of those who foresee a change, 9.3% expect a slight increase and 3.9% a slight decrease.

The longest average payment terms in Asia Pacific

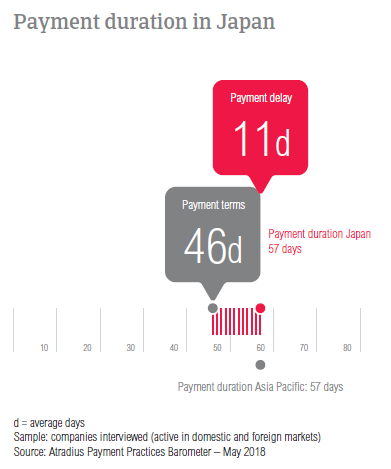

Historically, respondents in Japan are setting the longest average payment terms for their domestic and foreign B2B customers. In 2018, payment terms given to both domestic and foreign B2B customers have increased. More specifically, domestic B2B customers are given, on average, 46 days to settle their invoices. This is one day longer than in 2017. Foreign B2B customers are given, on average, 45 days to fulfil their payment obligations – three days longer than in 2017.

47% of respondents in Japan stated that they are not likely to differentiate payment terms between domestic and foreign B2B customers. Of the ones who mentioned a differentiation, 31% said that they are likely to give their domestic B2B customers shorter average payment terms and 21% that they are likely to give their foreign B2B customers less time to settle payments. The main reasons for differentiating payment terms in Japan are internal policies, industry practices and the financial risk related to the export transaction.

Minor changes have been reported with payment delays in Japan. In 2018, respondents in the country reported a decrease of two days in respect to domestic B2B customers (on average, 9 days) and an increase of two days in regards to foreign B2B customers (on average, 13 days).

In Japan, payment delays by B2B customers occurred mainly because of insufficient availability of funds and due to disputes over the quality of goods delivered and services provided. 36.5% of respondents in the country stated insufficient availability of funds in regards to their domestic B2B customers and 33.3% in regards to their foreign B2B customers. The second most frequently cited reason for payment delays in 2018 – disputes over the quality of goods delivered and services provided was cited by 31.1% of Japanese respondents in regards to their domestic B2B customers and by 33.3% of respondents in regards to their foreign B2B customers.

Among the Asia Pacific countries surveyed, Japan had the second highest percentage of respondents (42.7%) who stated that payment delays did not have a significant impact on their businesses. Of those who have experienced an impact, 10.8% said that they needed to take specific measures to correct cash flow and 9.2% that payment delays led to revenue loss.

In 2018, respondents in Japan need a longer time to convert B2B invoices into cash. The average payment duration in Japan increased from an average of 55 days in 2017 to 57 days this year.

Limited use of electronic invoices

Among the Asia Pacific countries surveyed, Japan had the highest percentage of respondents (49%) who said that they are not invoicing their domestic and foreign B2B customers electronically. This may be due to the fact that paperless invoicing is not permitted without explicit approval from the tax authorities in the country. 32% of respondents said that they make use of e-invoicing and 15% that they intend to start doing so in 2018.

Asked about the effect of e-invoicing on payment duration, the survey results are inconclusive. 53% of respondents said that after invoicing their B2B customers electronically, they received payments quicker and 46% that e-invoicing had no noteworthy effect.

51% of Japanese respondents do not expect turnover losses due to global protectionist measures

The fear of turnover losses due to trade uncertainty and global protectionist measures is not as pronounced in Japan. 51% of respondents here said that they do not expect the developments at global level to have an effect on their company’s turnover in the coming 12 months. Among the Asia Pacific countries surveyed, only Australia had a higher percentage of respondents stating this.

Of the respondents who believe that their companies might be affected, 15% mentioned that they expect a loss in turnover of up to 10% and 14% expect the impact will likely range between 20% and 30%. In contrast, 6% of respondents in Japan – probably focusing primarily on domestic B2B sales – expect to be positively impacted by protectionism around the globe.

High costs to pursue debtors – a top reason for write-offs next to bankruptcy

In 2018, Japan remains the country with the lowest average proportion of uncollectable receivables in Asia Pacific. There was a small improvement in the percentage of the total value of uncollectable B2B receivables which declined from 1.4% in 2017 to 1.2% this year. Domestic B2B receivables were written off more often than foreign ones.

Uncollectable receivables originated most often from B2B customers in electronics, business services and services. A common problem in the entire region – the customer going bankrupt or out of business – was also the main reason for write-offs in Japan (mentioned by 56.9% of respondents). The second most frequently reported reason for write-offs is the high cost of pursuing debtors, stated by 33.9% of respondents in the country.

B2B customers in the electronics sector some of the slowest payers

As mentioned previously, Japanese respondents give their B2B customers 46 days, on average, to fulfil their payment obligations. B2B customers in the agriculture and textiles sectors are given the longest average payment terms (67 days and 54 days respectively). In contrast, B2B customers in construction materials are being asked to pay the fastest (on average, within 15 days).

Suppliers in Japan reported that B2B customers in the electronics and chemicals sectors have been some of the slowest payers. B2B customers in these sectors, paid on average 13 and 17 days after the due date. The main reasons behind the payment delays in the electronics sector are the inefficiencies of the banking system (reported by 37% of respondents) and disputes over the quality of goods delivered and services provided (mentioned by 32% of Japanese respondents). The same main reasons have been reported by 37% of respondents in the chemicals industry.

Looking ahead, most respondents in Japan (67% and 80% respectively) do not foresee any changes in the payment behaviour of their B2B customers in the electronics and chemicals sectors.

Relaterede dokumenter

1.22MB PDF

1012KB PDF