In 2018, the average DSO recorded in the Netherlands is 46 days, an increase of five days compared to 2017. This is the biggest increase in Western Europe.

Of the Western European countries surveyed, the Netherlands had the highest percentage of respondents who said that over the past 12 months, overdue B2B invoices did not have a significant impact on their businesses. However, 43.6% of respondents said that their companies have been affected and they needed to take action. 14.9% of suppliers had to pursue additional financing and 14.4% had to request a bank overdraft. The Netherlands was also the country with the steepest increase in DSO, which climbed from 41 days in 2017 to 46 this year.

Decision to trade on credit based on business relationship

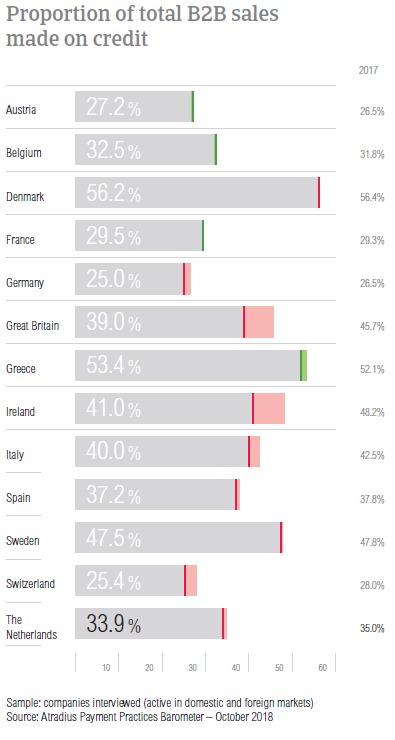

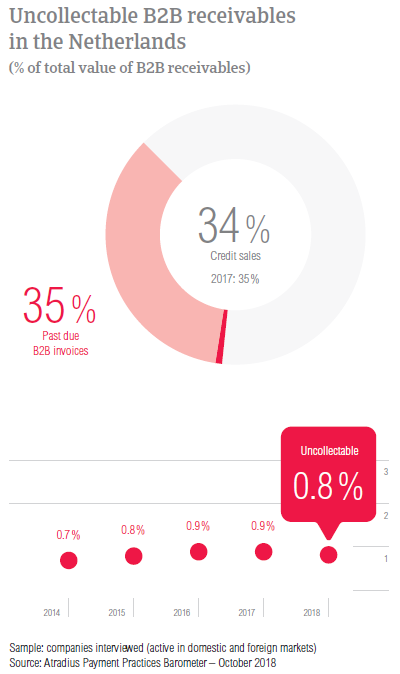

The proportion of total B2B sales made on credit in the Netherlands is stable at 33.9% (35.0% in 2017). Similarly to what was observed in previous years and like most of their peers in Western Europe, Dutch respondents are more inclined to trade on credit domestically than internationally. In 2018, 40.1% of domestic B2B sales and 27.7% of foreign B2B sales were made on credit.

Dutch suppliers said that they use trade credit in domestic B2B sales with customers whom they trust and with whom they have developed a long-term business relationship. Respondents in this country also believe that it is easier to trade on credit than to use other methods. However, if they lack information on the customer’s business or payment performance and if customers proved financially weak, Dutch suppliers would not extend trade credit (20.0% of respondents mentioned each of these reasons for not extending trade credit to their domestic customers).

We grant trade credit because this way we receive faster payments.

The main reasons for granting credit to B2B customers abroad mirror those on the domestic market: a collaboration developed over time which proved that the customers are creditworthy and the ease of trading on credit. 21.9% of respondents said that they would not sell on credit terms to financially weak customers. The second most frequently mentioned reason for not selling on credit to B2B customers abroad is a lack of information on the customer’s business or payment performance (28.1% of respondents cited this).

Trade credit is only provided to proven paying customers.

A steep increase in DSO

The percentage of Dutch respondents who reported late payments by B2B customers dropped significantly to 87.4% from 92.5% in 2017. This is in line with the regional average. Payment delays occurred more frequently from domestic B2B customers than from B2B customers abroad.

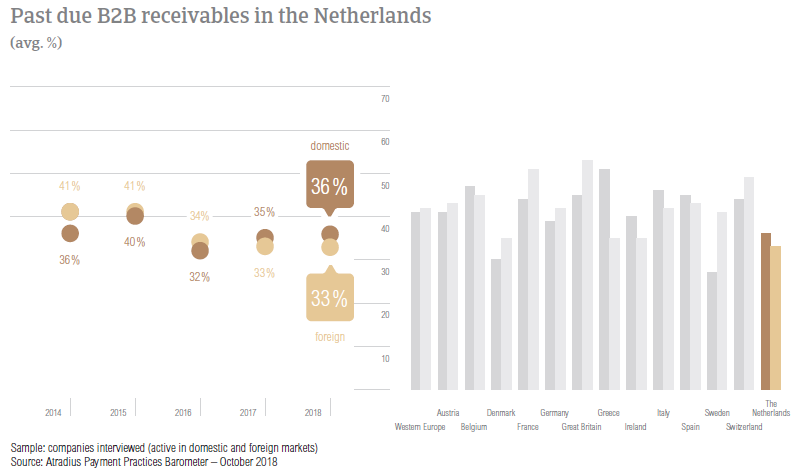

In 2018, the proportion of past due B2B invoices in the Netherlands is stable at 34.6%. This is far below the average for Western Europe overall. Past due B2B invoices of domestic customers were reported more often than those from foreign customers.

In 2018, the average Days Sales Outstanding (DSO) figure recorded in the Netherlands is 46 days, an increase of five days compared to 2017. This is the biggest increase in Western Europe and bringing the Netherlands’ average above the regional average. Looking at the coming 12 months, 68.3% of Dutch respondents said that they do not foresee any changes in their company’s DSO. Of those who expect changes, 10.0% anticipate an increase while 21.7% a decrease.

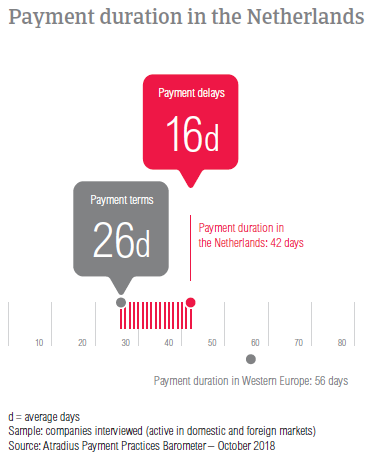

An increase in payment duration

2018 brought changes in the average payment terms given to B2B customers in the Netherlands. Dutch suppliers gave their domestic B2B customers, 27 days on average to pay invoices (five days longer than in 2017). At the same time, the average payment terms for foreign B2B customers are shorter at 24 days on average (26 days in 2017).

55.7% of respondents in the Netherlands stated that they are not likely to differentiate payment terms between domestic and foreign B2B customers. Should they differentiate, 26.8% of suppliers said that they would give their domestic B2B customers less time to settle invoices while 17.5% said that they are likely to give domestic B2B customers more time. Dutch suppliers said that they differentiate payment terms mainly because of internal policies, the financial risk associated to the export transaction and industry practices.

In 2018, suppliers in the Netherlands reported an increase in payment delays by B2B customers abroad. These went up from an average of 12 days in 2017 to 17 days this year. There were no changes in terms of domestic payment delays (on average 15 days).

The changes in payment terms and small increase in payment delays resulted in a four day increase in the average payment duration, which now stands at 42 days. Despite this deterioration, Dutch suppliers, next to their peers in Germany, manage to convert B2B invoices into cash the fastest in the region.

Domestic payment delays in the Netherlands occurred mainly because of insufficient availability of funds (mentioned by 34.6% of respondents) and the complexity of the payment procedure (30.9%). Significantly fewer respondents stated insufficient availability of funds compared to one year ago when 52.8% of respondents stated this. The percentage recorded in the Netherlands is also far below the regional average of 47.3%. In contrast, the percentage of respondents citing complexity of the payment procedure increased significantly compared to 2017 when it stood at 18.9%.

The main reasons for payment delays by foreign B2B customers in the Netherlands are disputes over the quality of goods and services provided (mentioned by 30.2% of respondents) and insufficient availability of funds (cited by 27.0% of respondents). The percentage of respondents stating the disputes over the goods or service almost doubled compared to 2017 (when it was 17.2%), while fewer respondents mentioned insufficient availability of funds.

43.6% of suppliers in the Netherlands mentioned that their companies have been affected by overdue B2B invoices in the last 12 months. While this is the lowest average percentage of the Western European countries surveyed, 14.9% of those impacted reported that they needed to pursue additional financing and 14.4% that they needed to request a bank overdraft extension.

Dutch suppliers are mostly invoicing online

The majority of respondents in the Netherlands (65.5%) said that they are using online invoicing with their domestic and foreign B2B customers. Another 9.4% want to make the move towards the online environment this year. In contrast, 23.2% said that they do not use e-invoicing and only 2.0% that they are no longer use it.

49.2% of Dutch respondents believe that electronic invoices accelerated payments. In contrast, a low 10.9% experienced slowdowns in payment and 39.8% did not notice a noteworthy effect on payment duration.

US protectionism – ranked most significant potential risk

43.2% of Dutch respondents ranked US protectionism turning into a trade war as a more significant risk to global growth in the next six months than Fed policy becoming misguided, a ‘hard landing’ by China and geopolitical risk. This response rate was consistent with that of the region overall. 24.8% of Dutch suppliers said that US protectionism is indeed a significant risk but not the most significant one. Geopolitical risk was seen as the most significant risk by the second most respondents in the Netherlands (25.2%).

Bankruptcy mentioned less often as a top reason for write-offs

In 2018, the average proportion of uncollectable receivables in the Netherlands remained stable at 0.8% (0.9% in 2017). Similarly to what was observed in the past, mostly domestic B2B receivables were written off as uncollectable.

Uncollectable receivables originated most often from B2B customers in the construction, electronics, consumer durables business services and services industries. B2B receivables were reported to be uncollectable mainly because of the customer going bankrupt or out of business. While 52.8% of respondents stated this, there was a significant reduction compared to 2017 when bankruptcy was the main reason for uncollectables for 60.4% of respondents. Secondary reasons were the high costs to pursue the debtors (mentioned by 25.8%) and the inability to locate the customer (24.7% of respondents).

Consumer durables – a problematic sector in 2018

After a small increase in 2018, the average payment term given in the Netherlands is 26 days. B2B customers in the consumer durables, construction materials and agriculture sectors enjoyed payment terms significantly longer than the country average. More specifically, Dutch suppliers gave their B2B customers in consumer durables 47 days to complete payments while B2B customers in construction materials and those in agriculture were given 45 days on average. In contrast, B2B customers in the electronics sector and those in the transport sector were asked to pay within 22 days.

Despite the longer payment terms offered, B2B customers in the consumer durables sector paid on average, 43 days after the due date, generating some of the longest delays. The top reasons for payment delays in this sector were insufficient availability of funds and buyers using outstanding invoices as a form of financing (each of these reasons reported by 34.0% of respondents).

Looking at the coming 12 months, 67.0% of suppliers in the Netherlands do not expect changes in the payment behaviour of their B2B customers in consumer durables. Of those who foresee changes, 14.0% expect deterioration and 18.0% improvement.